Economy of Pakistan....

The economy of Pakistan is the 25th largest in the world in terms of purchasing power parity (PPP), and 38th largest in terms of nominal gross domestic product. Pakistan has a population of over 190 million (the world's 6th-largest), giving it a nominal GDP per capita of $1,450, which ranks 141st in the world. However, Pakistan's undocumented economy is estimated to be 36% of its overall economy, which is not taken into consideration when calculating per capita income.[20] Pakistan is a developing country[21][22][23] and is one of the Next Eleven, the eleven countries that, along with the BRICS, have a potential to become one of the world's large economies in the 21st century.[24] However, after decades of war and social instability, as of 2013, serious deficiencies in basic services such as railway transportation and electric power generation had developed.[25] The economy is semi-industrialized, with centres of growth along the Indus River.[26][27][28] Primary export commodities include textiles, leather goods, sports goods, chemicals and carpets/rugs.[29]

Growth poles of Pakistan's economy are situated along the Indus River;[27][30] the diversified economies of Karachi and major urban centers in the Punjab, coexisting with lesser developed areas in other parts of the country.[27] The economy has suffered in the past from internal political disputes, a fast-growing population, mixed levels of foreign investment.[25] Foreign exchange reserves are bolstered by steady worker remittances, but a growing current account deficit – driven by a widening trade gap as import growth outstrips export expansion – could draw down reserves and dampen GDP growth in the medium term.[31] Pakistan is currently undergoing a process of economic liberalization, including privatization of all government corporations, aimed to attract foreign investment and decrease budget deficit.[32] In 2014, foreign currency reserves crossed $18.4 billion[33] which has led to stable outlook on the long-term rating by Standard & Poor's.[34][35] In 2016, BMI Research report named Pakistan as one of the ten emerging economies with a particular focus on of it's manufacturing hub.[36]

Contents [hide]

1 Economic history

1.1 First five decades

1.2 Recent decades

1.3 Economic resilience

1.3.1 Background

1.4 Macroeconomic reform and prospects

1.4.1 Doing business

2 The economy today

2.1 Multinationals

2.2 Stock market

2.3 Middle class

2.4 Poverty alleviation expenditures

2.4.1 Employment

2.5 Tourism

2.6 Revenue

3 Currency system

3.1 Rupee

3.2 Foreign exchange rate

3.3 Foreign exchange reserves

4 Structure of economy

5 Major Sectors

5.1 Primary

5.1.1 Agriculture

5.1.2 Mining

5.2 Secondary

5.2.1 Industry

5.2.2 Construction material

5.2.3 Information Communication Technology Industry

5.2.4 Defence Industry

5.2.5 Textiles

5.2.6 Other

5.3 Services

5.3.1 Communication

5.3.2 Transportation

5.3.3 Finance

5.3.4 Housing

5.3.5 Minor Sectors

5.3.6 Energy

5.3.7 Chemicals and pharmaceuticals

6 Foreign trade, remittances, aid, and investment

6.1 Investment

6.1.1 Foreign acquisitions and mergers

6.2 Foreign trade

6.2.1 Exports

6.3 External imbalances

6.4 Economic aid

6.5 Remittances

7 Government finances

7.1 Revenues and taxation

7.2 Expenditures (and the economic costs of War on Terror)

7.3 Sovereign bonds

8 Income distribution

9 See also

10 Further reading

11 References

12 External links

Economic history[edit]

Main article: Economic history of Pakistan

First five decades[edit]

Pakistan was a very poor and predominantly agricultural country when it gained independence in 1947. Pakistan's average economic growth rate in the first five decades (1947–1997) has been higher than the growth rate of the world economy during the same period. Average annual real GDP growth rates[37] were 6.8% in the 1960s, 4.8% in the 1970s, and 6.5% in the 1980s. Average annual growth fell to 4.6% in the 1990s with significantly lower growth in the second half of that decade.[38]

Recent decades[edit]

This is a chart of trend of gross domestic product of Pakistan at market prices estimated[39] by the International Monetary Fund with figures in millions of Pakistani Rupees. See also[38]

Year Gross Domestic Product US Dollar Exchange Inflation Index

(2000=100) Per Capita Income

(as % of US)

1960 20,058 4.76 Pakistani Rupees 3.37

1965 31,740 4.76 Pakistani Rupees 3.40

1970 51,355 4.76 Pakistani Rupees 3.26

1975 131,330 9.91 Pakistani Rupees 2.36

1978 283,460 9.97 Pakistani Rupees 21 2.83

1985 569,114 16.28 Pakistani Rupees 30 2.07

1990 1,029,093 21.41 Pakistani Rupees 41 1.92

1995 2,268,461 30.62 Pakistani Rupees 68 2.16

2000 3,826,111 51.64 Pakistani Rupees 100 1.54

2005 6,581,103 59.86 Pakistani Rupees 126 1.71

2014 22,032,565 105.95 Pakistani Rupees 260

2016 45,680,351 106.95 Pakistani Rupees 370

Economic resilience[edit]

GDP Rate of Growth 1951–2009

Background[edit]

Historically, Pakistan's overall economic output (GDP) has grown every year since a 1951 recession. Despite this record of sustained growth, Pakistan's economy had, until a few years ago, been characterised as unstable and highly vulnerable to external and internal shocks. However, the economy proved to be unexpectedly resilient in the face of multiple adverse events concentrated into a four-year (1998–2002) period —

the Asian financial crisis;

economic sanctions – according to Colin Powell, Pakistan was "sanctioned to the eyeballs";[40]

The global recession of 2001–2002;

a severe drought – the worst in Pakistan's history, lasting about four years;

the post-9/11 military action in neighbouring Afghanistan, with a massive influx of refugees from that country;

Macroeconomic reform and prospects[edit]

National Highways, Motorways & Strategic Roads of Pakistan.

According to many sources, the Pakistani government has made substantial economic reforms since 2000,[41] and medium-term prospects for job creation and poverty reduction are the best in nearly a decade.

In 2005, the World Bank reported that

"Pakistan was the top reformer in the region and the number 10 reformer globally – making it easier to start a business, reducing the cost to register property, increasing penalties for violating corporate governance rules, and replacing a requirement to license every shipment with two-year duration licences for traders."[42]

Doing business[edit]

The World Bank (WB) and International Finance Corporation's flagship report Ease of Doing Business Index 2015 ranked Pakistan 138 among 189 countries around the globe. Pakistan came highest in South Asia and also was ranked higher than China and Russia which were at 133. The top five countries were Singapore, New Zealand, the United States, Hong Kong and United Kingdom.[43]

Many Western companies refuse to do business with Pakistan and cite problems of courrption, lack of resources and lack of infrastructure as key problems.[44]

The economy today[edit]

Today the Nominal GDP of Pakistan is 270.96 USD which is better than its last decades performance due to high growth rate.[45]

Economic comparison of Pakistan 1999–2008

A view of I. I. Chundrigar Road, the financial district of Karachi in Pakistan

Main Industries by Region - Pakistan. Source:[46]

Indicator 1999 2007 2008 2009 2015

GDP $75 billion $160 billion $170 billion $185 billion $270.96 billion

GDP Purchasing Power Parity (PPP) $270 billion $475.5 billion $504 billion $545.6 billion $928.43 billion (PPP,2015)

GDP per Capita Income $450 $925 $1085 $1250 $1513

Revenue collection Rs. 305 billion Rs. 708 billion Rs. 990 billion Rs. 1.05 trillion Rs 2.65 trillion

Foreign reserves $1.96 billion $16.4 billion $8.89 billion $17.21 billion $20 billion

Exports $8.5 billion $18.5 billion $19.22 billion $18.45 billion $30.414 billion (2013–14 est.)

Textile Exports $5.5 billion $11.2 billion – –

KHI stock exchange (100-Index) $5 billion at 700 points $75 billion at 14,000 points $46 billion at 9,300 points $26.5 billion at 9,000 points

Foreign Direct Investment $1 billion $8.4 billion $5.19 billion $4.6 billion $0.709 billion [21]

External Debt & Liabilities $39 billion $40.17 billion $45.9 billion $50.1 billion $56 billion

Poverty level 60% 43% 37% 29% 17%

Literacy rate 45% 53% 59% 61% 65%[22]

Development programs Rs. 80 billion Rs. 520 billion Rs. 549.7 billion Rs. 621 billion Rs758 billion

In 2016 the Atlantic Media Company (AMC) of the United States has ranked Pakistan as a relatively stronger economy in the South Asian markets and expected that it will grow rapidly during days ahead. AMC said that during the period January-July this year, Indian 100 point index was 6.67% while Karachi Stock Exchange (KSE) had achieved 100 point index of 17 percent. [23]

Multinationals

This section does not cite any sources. Please help improve this section by adding citations to reliable sources. Unsourced material may be challenged and removed. (March 2016) (Learn how and when to remove this template message)

Lotte, ChinaMobile, Toyota, Haier, GDF-Suez, Citi, Colgate-Palmolive, Shell, Hutchinson, Marriott Hotels, Coca Cola, McDonalds, Telenor, Nestlé, Honda, GSK, Movenpick Hotels, Linde Groupe, Standard Chartered, Yamaha, ABB, Novartis, ICBC, Pepsi, Unilever, Uber, Abbott Labs, Johnson & Johnson, McKinsey, Excelerate Energy, Total, eni spa, OMV, UEPL, YUM! brands, Gunvor, Emaar, Deutsche Bank, SIEMENS, Sanofi, Orix, Otsuka, Nike, maybank, metro AG, Vitol, Omantel, g.e., AzkoNobel, BASF, Vestas, Temasek, FrieslandCampina International Holding BV, Audi, Philip Morris International, DPW, Oxford University Press, IBM, The Bank of Tokyo-Mitsubishi UFJ, Mol Group, Tetra Pak, Philips, Vopak, Abraaj, British American Tobacco, Schlumberger, Allianz, Exterran, Toni&Guy, Deloitte, etisilat, P&G, KSB, Hyperstar-Carrefour, Nippon Paint, Wyndham Hotels, 3M, Stora Enso Oyj, DHL, FedEx, Ace Insurance, Visa, Agility Logistics, Huawei, Nielsen, Samba Bank, Abu Dhabi Group, Serena Hotels , Emirates Logistics, Samsung, Descon.

Stock market

Main articles: Karachi Stock Exchange, Lahore Stock Exchange, Islamabad Stock Exchange, and Sialkot Trading Floor

In the first four years of the twenty-first century, Pakistan's KSE 100 Index was the best-performing stock market index in the world as declared by the international magazine "Business Week".[47][citation needed] The stock market capitalisation of listed companies in Pakistan was valued at $5,937 million in 2005 by the World Bank.[48] But in 2008, after the General Elections, uncertain political environment, rising militancy along western borders of the country, and mounting inflation and current account deficits resulted in the steep decline of the Karachi Stock Exchange. As a result, the corporate sector of Pakistan has declined dramatically in recent times. However, the market bounced back strongly in 2009 and the trend continues in 2011. By 2014 the stock market burst into uncharted territories as the benchmark KSE 100 Index rose 907 points (3.1%) and shot past the 30,000-point barrier to close at a new record high, this came days after Moody’s announced that it was upgrading the outlook of 5 major Pakistani banks from Negative to Stable, resulting in heavy buying in the banking sector. The rally was supported by heavy buying in the oil and gas and cement sectors.[49] An article published in The Journal of Developing Areas of Tennessee State University in the US, economist Mete Feridun investigates the exchange rate movements in the Pakistani foreign exchange market using the market micro structure approach, shedding more lights on the dynamics of the Pakistani Stock Exchange.[50]

Middle class

See also: Labour force of Pakistan

As of 2013, according to Macro Economic Insights, a research firm in Islamabad, the size of the Pakistani middle class is conservatively estimated at approximately 70 million, out of a total population of about 186 million. This represents 40% of the population of the country.[51]

On measures of income inequality, the country ranks slightly better than the median. In late 2006, the Central Board of Revenue estimated that there were almost 2.8 million income-tax payers in the country.[52] However, by 2013, the number of taxpayers was drastically reduced to just 768,000 out of a total population of 190 million, meaning that only 0.57% of the population pay taxes[53]

Poverty levels have decreased by 10% since 2001[54] Foreign Companies which provide for Pakistani middle classes have been very successful. For example, demand for Unilever products have recently been so high that even after doubling production the Anglo-Dutch company struggled to meet demand and its chairman stated "Pakistanis can’t seem to have enough".[55]

Poverty alleviation expenditures

Main article: Poverty in Pakistan

Socio-Economic Status of Pakistanis, source:[56]

Pakistan government spent over 1 trillion Rupees (about $16.7 billion) on poverty alleviation programmes during the past four years, cutting poverty from 35% in 2000–01 to 24% in 2006.[8] Rural poverty remains a pressing issue, as development there has been far slower than in the major urban areas.

Employment

The high population growth in the past few decades has ensured that a very large number of young people are now entering the labor market. Even though it is among the six most populous Asian nations. In the past, excessive red tape made firing from jobs, and consequently hiring, difficult.[57] Significant progress in taxation and business reforms has ensured that many firms now are not compelled to operate in the underground economy.[58]

In late 2006, the government launched an ambitious nationwide service employment scheme aimed at disbursing almost $2 billion over five years.[59][60]

Mean wages were $0.98 per man-hour in 2009. Rate of unemployment is 15%.

High inflation and limited wage growth have drawn more women into the workforce to feed their families.[61]

Government sector is also contributing in employment and according to estimate 4.5 million people are employed by federal , provincial and local governments in different sectors from Armed forces to education and health. [62]

Touris

Main article: Tourism in Pakistan

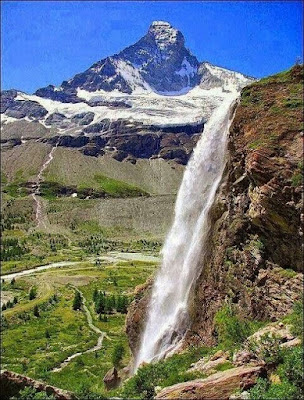

Malam Jabba Ski Resort, Swat, Kyber Pakhtunkhwa, Pakistan

Faisal Mosque in the capital Islamabad.

Tourism in Pakistan has been stated as being the tourism industry's "next big thing". Pakistan, with its diverse cultures, people and landscapes, has attracted 90 million tourists to the country, almost double to that of a decade ago. Due to threat of terrorism the number of foreigner tourists has gradually declined and the shock of 2013 Nanga Parbat tourist shooting has terribly adversely effected the tourism industry.[63]

Revenue

Although the country is a Federation with constitutional division of taxation powers between the Federal Government and the four provinces, the revenue department of the Federal Government, the Federal board of Revenue, collects almost 95% of the entire national revenue. The Federal Board of Revenue collected nearly two trillion rupees ($24 p .1 billion) in taxes in the 2007–2008 financial year,[64] while it collected about 1558 billion ($18.3 billion) during FY 2010–2011.

Currency system

Main article: Pakistani rupee